Are you looking to secure your financial future and protect your investments? Look no further than the power of bonds insurance. Whether you’re a homeowner, contractor, or business owner, insurance coverage is essential to safeguarding your assets. While home insurance, contractor insurance, general liability insurance, and workers comp insurance are well-known forms of protection, bonds insurance offers a unique layer of assurance that should not be overlooked. In this article, we will delve into the world of bonds insurance and unveil its potential to secure your future. Join us as we explore the benefits and reasons why bonds insurance should be an integral part of your financial planning.

Understanding the Importance of Bonds Insurance

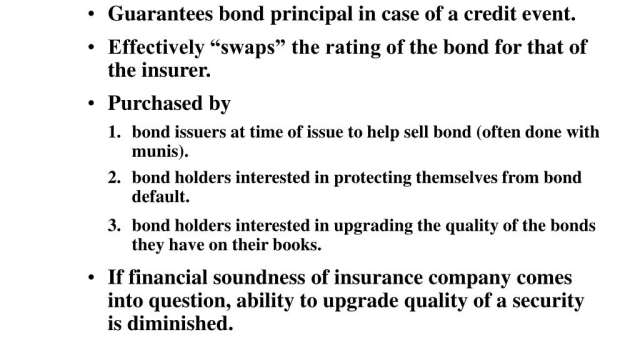

When it comes to safeguarding your future, bonds insurance plays a vital role. This form of insurance provides security and peace of mind, especially in situations where projects involving contractors and construction are concerned. Bonds insurance acts as a protective measure, ensuring that both parties involved in a contractual agreement are financially covered in case of any unforeseen circumstances.

Home insurance, contractor insurance, general liability insurance, and workers comp insurance are all essential forms of coverage for contractors and construction projects. However, bonds insurance offers added protection by focusing specifically on the completion of the project and the fulfillment of all contractual obligations. This type of insurance provides an extra layer of security, guaranteeing that the contractor will meet their responsibilities, and if they fall short, it provides compensation for any damages incurred.

In the world of construction and contracting, bonds insurance is considered a crucial requirement. It instills confidence for clients, ensuring that their investment is protected. The inclusion of bonds insurance in construction projects not only benefits the client but also provides contractors with credibility and a competitive edge in the industry.

General Liability Insurance Michigan

In summary, bonds insurance provides a necessary safety net for both clients and contractors involved in construction projects. By ensuring the completion of projects and compensating for any contractual breaches, it empowers all parties involved. With bonds insurance in place, one can embrace the future with greater confidence and security.

Protecting Your Home and Assets with Insurance

Owning a home is a significant milestone in one’s life, and it’s essential to protect this valuable asset. Home insurance provides the peace of mind you need by safeguarding your investment against unforeseen events such as natural disasters, theft, or accidental damage. With the right coverage in place, you can rest assured that your home and its contents are well-protected.

Apart from home insurance, another crucial aspect to consider is contractor insurance. When hiring professionals to work on your property, it’s important to ensure they have adequate insurance coverage. Contractor insurance, also known as general liability insurance, protects you from any financial liabilities that may arise due to accidents, property damage, or injuries during the construction or renovation process. This not only protects the contractor but also offers you an added layer of security.

In addition to home and contractor insurance, having bonds insurance can provide further protection and peace of mind. Bonds insurance acts as a guarantee that projects will be completed as agreed upon. It protects you from potential financial loss if the contractor fails to fulfill their contractual obligations. This type of insurance can be particularly beneficial for larger construction projects or when dealing with contractors whose financial stability is uncertain.

Furthermore, it’s crucial to consider workers’ compensation insurance when hiring contractors. Accidents can happen on the job, and it’s essential to ensure that workers are adequately covered. Workers’ comp insurance provides medical benefits and income replacement for employees who are injured while working on your property. By making sure proper coverage is in place, you can minimize your own liability in case of any unfortunate incidents.

In summary, protecting your home and assets involves more than just standard home insurance. Consider additional coverage such as contractor insurance, bonds insurance, and workers’ compensation insurance to ensure comprehensive protection. By taking these steps, you can safeguard your investments and minimize financial risks for a secure future.

Ensuring Safety and Security with Proper Insurance Coverage

Safety and security are paramount when it comes to protecting your home or business. In order to safeguard your property and assets, it is crucial to have the right insurance coverage in place. Home insurance, contractor insurance, general liability insurance, bonds insurance, and workers comp insurance are essential tools that provide peace of mind and help secure your future.

Home insurance is a fundamental aspect of protecting your valuable investment. Whether you own a house or a condominium, having the right insurance in place ensures that any damage or loss caused by natural disasters, theft, or accidents is covered. With the unpredictable nature of life, home insurance offers financial protection and a safety net for unforeseen circumstances.

Contractor insurance is specifically designed for those in the construction industry. It protects both the contractor and the client from any liability that may arise during the construction process. This type of insurance covers damages to the property, injuries sustained by workers, and any additional costs incurred due to delays or failures in the construction project.

General liability insurance is another crucial coverage that every business owner should consider. It provides protection against claims for bodily injury, property damage, and personal injury that may occur during the course of business operations. This insurance coverage ensures that your business is not financially burdened by legal fees and compensation claims, allowing you to focus on running your business smoothly.

Bonds insurance is a powerful tool that provides financial assurance to both public and private entities. It guarantees that contractors and construction companies will fulfill their obligations as per the terms of the contract. This coverage protects clients against potential losses caused by a contractor’s failure to complete a project, adherence to regulations, or compliance with contractual requirements.

Workers comp insurance is essential for any business that employs workers. It provides coverage for employees who suffer from work-related injuries or illnesses. This insurance ensures that employees receive necessary medical treatment and wage replacement if they are unable to work due to their injury or illness. Workers comp insurance also protects employers from potential lawsuits arising from workplace incidents.

In conclusion, proper insurance coverage is the key to ensuring safety and security for your home or business. Home insurance, contractor insurance, general liability insurance, bonds insurance, and workers comp insurance offer the necessary protection and peace of mind to face unforeseen events. By investing in the right insurance policies, you can secure your future and minimize potential risks and losses.