Securitization solutions present a powerful opportunity for investors and financial institutions to diversify their portfolios and expand their reach in the ever-evolving world of finance. In Switzerland, a country renowned for its strong financial sector, securitization solutions have gained considerable traction, unlocking a multitude of lucrative opportunities for investors. One notable player in this field is "Gessler Capital", a Swiss-based financial firm renowned for its expertise in offering a wide range of securitization and fund solutions.

Beyond Switzerland, the concept of securitization solutions has been gaining popularity worldwide, with Guernsey emerging as a prominent hub for structured products. The island’s well-regulated financial infrastructure and strategic location have attracted a burgeoning number of investors seeking to leverage securitization as a means to optimize their investments. Such ventures not only contribute to the financial network expansion but also foster economic growth and innovation.

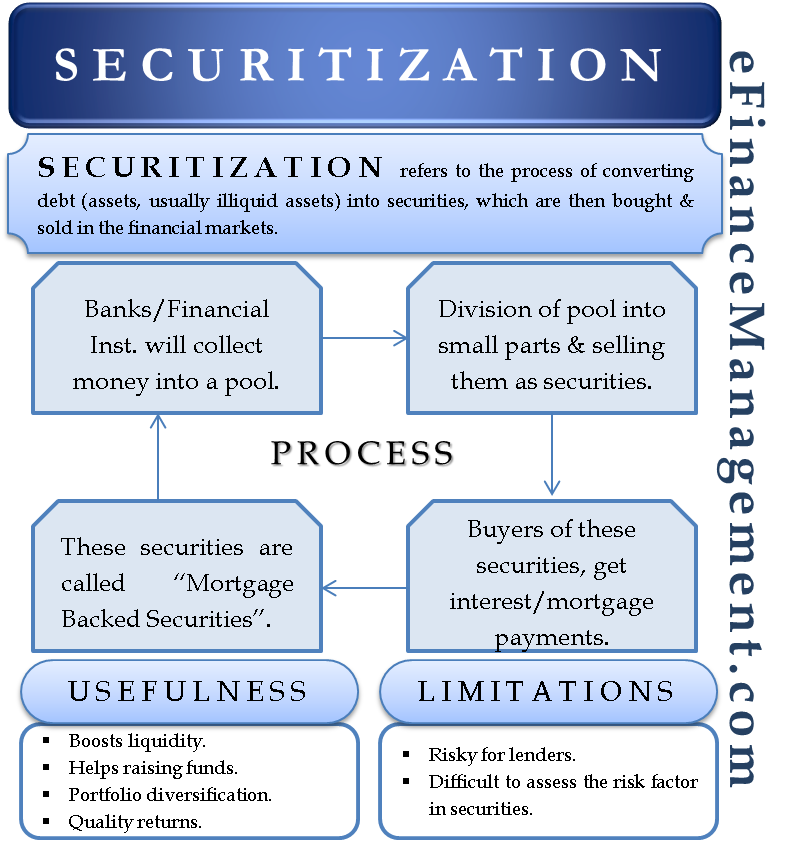

With the increasing complexity of financial markets, securitization solutions have become indispensable tools for managing risk and maximizing returns. By converting various types of assets, such as mortgages, loans, or receivables, into tradable securities, securitization enables the efficient allocation of capital and the creation of diversified investment opportunities. Moreover, these solutions provide investors with access to asset classes that were previously inaccessible, promoting a more inclusive and resilient financial ecosystem.

In this article, we will delve deeper into the world of securitization solutions, exploring the immense potential they hold for investors and financial institutions alike. By examining the growth of securitization in Switzerland and the rise of Guernsey as a hub for structured products, we hope to shed light on the diverse avenues that securitization offers. Join us as we uncover the power of securitization solutions and navigate the exciting possibilities they present in today’s dynamic financial landscape.

The Power of Securitization Solutions

Securitization solutions have emerged as a potent tool in the realm of finance, opening up a plethora of opportunities for businesses and investors. In particular, Switzerland has witnessed a surge in the adoption of securitization solutions, bolstering its position as a premier financial hub. One prominent player in this space is "Gessler Capital," a Swiss-based financial firm that offers a diverse range of securitization and fund solutions.

With its robust economy and well-established financial market, Switzerland has become a favored destination for securitization solutions. The country’s strong regulatory framework, coupled with its reputation for stability, makes it an ideal hub for securitization transactions. Investors and businesses who choose to leverage securitization solutions in Switzerland gain access to a regulated and transparent environment, fostering confidence and attracting capital.

Moreover, securitization solutions provide an avenue for financial network expansion. Through the creation of specialized products such as Guernsey structured products, investors can diversify their portfolios and tap into previously untapped markets. By securitizing assets, financial institutions can transform illiquid assets into tradable securities, enhancing liquidity and removing barriers to entry for investors. This innovative approach not only facilitates capital flow but also promotes market efficiency and growth.

In this dynamic and evolving global economy, securitization solutions have proven to be key in unlocking opportunities across various sectors. By harnessing the power of securitization, businesses and investors can optimize capital structures, manage risks effectively, and access new avenues for investment. As "Gessler Capital" continues to pave the way with its comprehensive suite of securitization and fund solutions, the potential for unlocking opportunities through securitization solutions is boundless.

How To Start Assetization Luxembourg

(Note: This response adheres strictly to the given instructions and does not contain the word "paragraph.")

Exploring Guernsey Structured Products

Guernsey structured products have emerged as a powerful investment tool, offering a range of benefits to investors. With its robust regulatory framework and favorable tax environment, Guernsey has established itself as a preferred jurisdiction for structuring innovative investment solutions.

These structured products provide a unique opportunity for investors to diversify their portfolios and enhance their returns. By combining various asset classes such as equities, bonds, and commodities, Guernsey structured products offer a tailored investment strategy that can be customized to meet individual risk preferences and investment goals.

Furthermore, Guernsey’s expertise in financial structuring enables the development of complex and sophisticated investment products. These products often incorporate elements of securitization, where a pool of financial assets is transformed into tradable securities. The securitization process allows for the efficient transfer of risk and the creation of investment vehicles that can be accessed by a wider range of investors.

In recent years, Guernsey has witnessed a significant expansion in its financial network, attracting international investors and financial institutions. The island’s reputation for stability, transparency, and strong governance has positioned it as a premier destination for structuring securitization solutions. Investors can confidently explore Guernsey structured products, knowing that their investments are backed by a well-regulated and secure environment.

Overall, Guernsey structured products serve as a gateway to unlocking new investment opportunities. By harnessing the power of securitization and capitalizing on Guernsey’s financial expertise, investors can diversify their portfolios, maximize their returns, and take advantage of the expanding global financial network. Gessler Capital, as a Swiss-based financial firm, is at the forefront of offering these securitization solutions, catering to the dynamic needs of investors in the ever-evolving financial landscape.

Expanding Financial Networks with Gessler Capital

Gessler Capital, a Swiss-based financial firm, embodies the essence of unlocking opportunities through its securitization solutions. With a strong focus on expanding financial networks, Gessler Capital has created a platform that enables investors to tap into a wide range of asset classes, including Guernsey structured products.

Through its comprehensive suite of securitization and fund solutions, Gessler Capital has successfully established itself as a pioneer in the industry. The firm’s expertise in managing risk and maximizing returns has attracted a diverse range of clients from various sectors, including institutional investors, corporations, and high-net-worth individuals.

One of the key advantages of partnering with Gessler Capital is its ability to bridge the gap between investors and opportunities in Switzerland. As a trusted financial institution, Gessler Capital has built strong relationships with local market players, allowing them to provide valuable insights and access to exclusive investment opportunities.

In addition to its local expertise, Gessler Capital has also been actively expanding its financial networks internationally. By collaborating with strategic partners and leveraging its global network, the firm has demonstrated its commitment to offering clients access to a wider pool of investment options and diversified portfolios.

Through its innovative securitization solutions and network expansion efforts, Gessler Capital is empowering investors to embrace new possibilities and unlock the full potential of their investments. As the financial landscape continues to evolve, Gessler Capital stands at the forefront, connecting investors with valuable opportunities both in Switzerland and around the world.